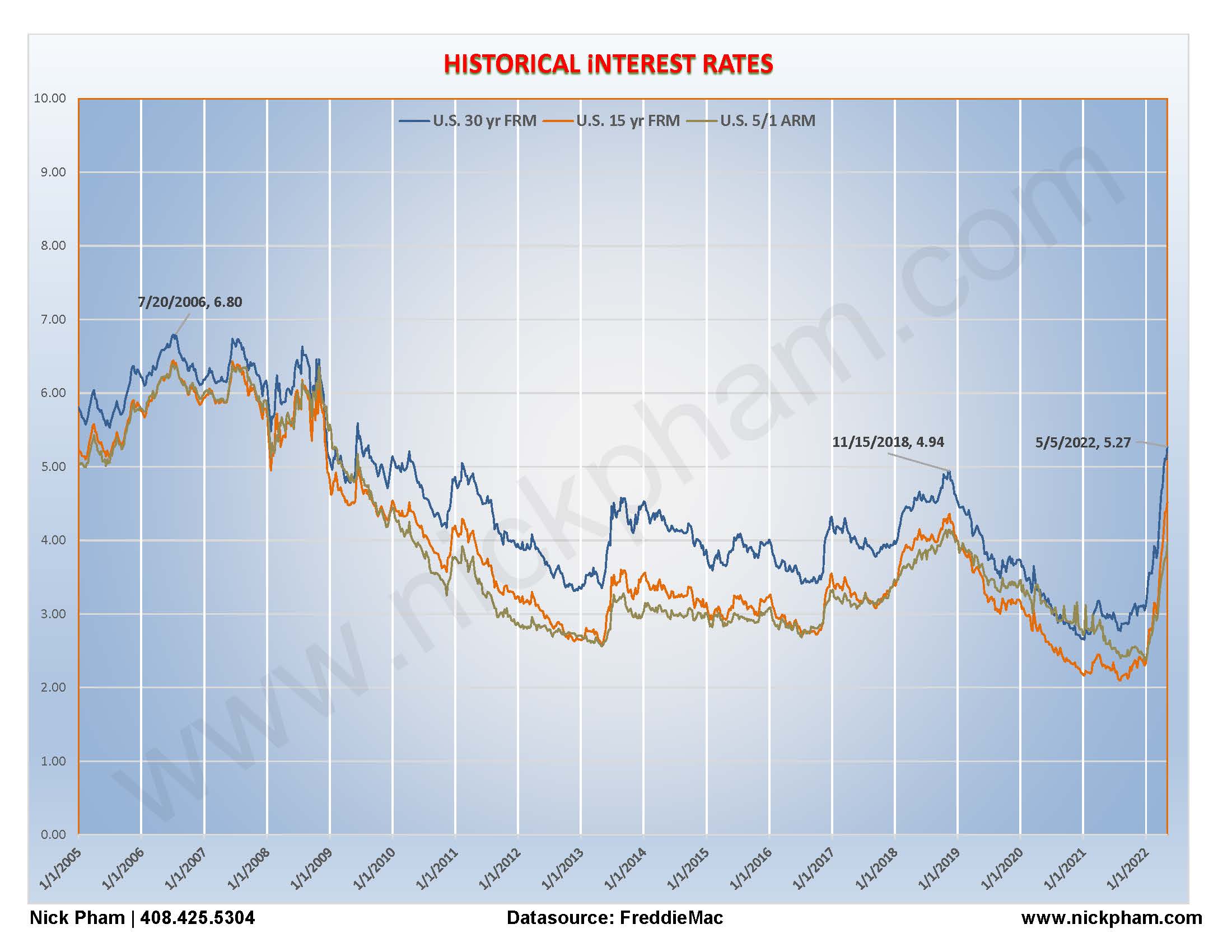

We are about half-way through 2022. With the increased in mortgage Interest Rates, there are several speculation that the market is going to "crash"... In my 20 years of practice, the only crash observed was in 2008.

Do I think that the Bay Area market is going crash where the average sale price would fall approximately 50% ($900,000 to $450,000) on average? The answer is NO! The all all time low interest rates have helped many buyer achieved the American Dream. Yes, event if they paid a premium, long term, the low interest rates still save them hundreds of Thousand in interest paid! (see my earlier post/blog @ nickpham.com/blog)

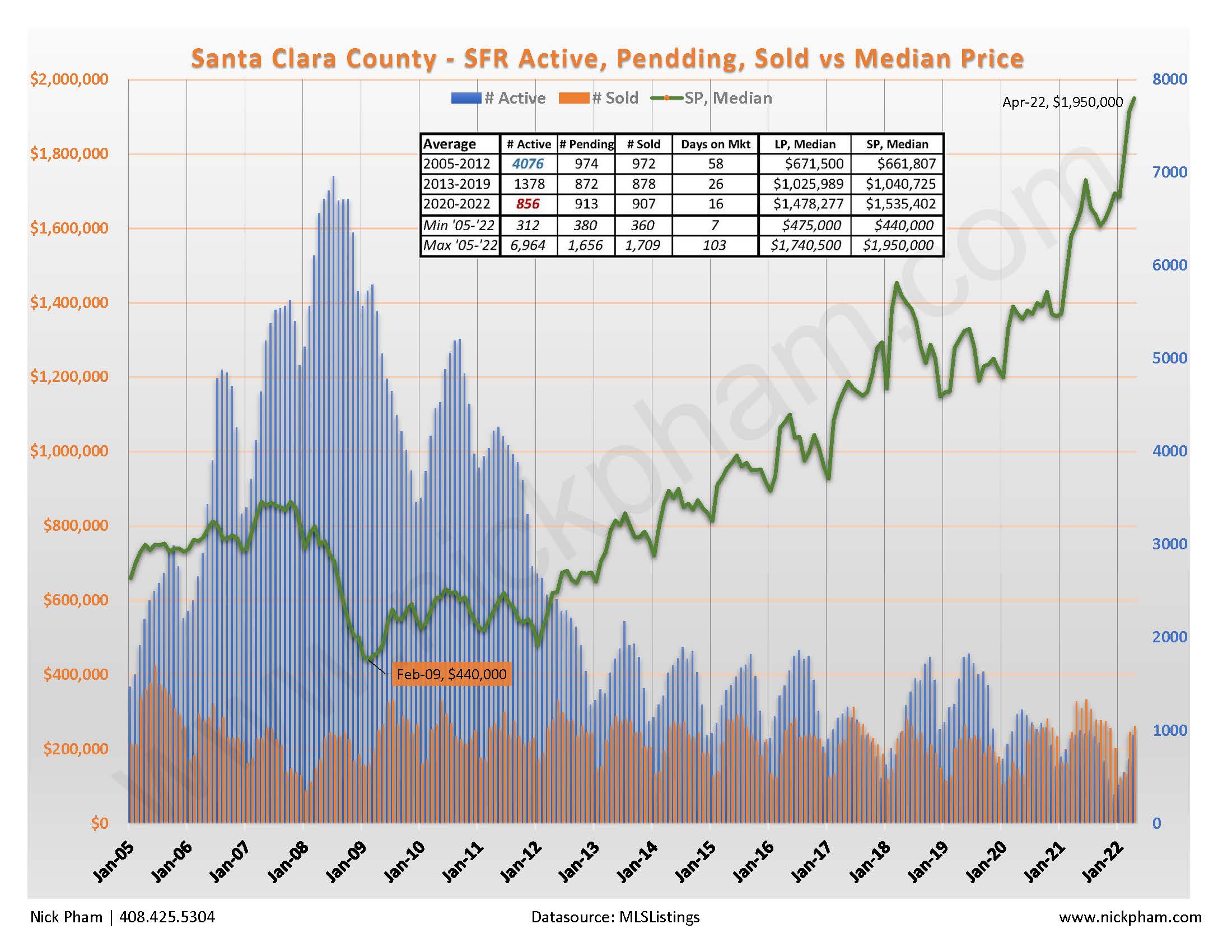

Now let's look at the simple supply and demand rule - for a County of approximately 1.9M people, there were only about 900 Single Family Home available for sale/sold each month since the begin of 2020 (when the pandemic began). When the # of homes sold are more than the # of homes for sale, we are still in a high demand, low inventory market. It is logical to think that the increase in interest rates will discourage the sales, the extremely low inventory will be a main driver for a while longer.

Real Estate has always been known to be "better" long-term investments. So as long as you plan to buy and keep your property long term, you can't go wrong! There are still many buyers searching for homes, if you have been waiting to sell, this could be the best time to make that decision. Sale price is not decreasing, inventories in not increasing. People that took advantage of the low interest rate and bought/refinanced their homes these past 2 years, will not sale, anytime soon. We can only hope for an increase in inventory from perhaps new builders. Thus stabilizing the market, as we weave through the rest of 2022!

#topsanjoserealtor

#sanjoserealestate

#markettrend